The State of Cryptocurrency in 2023 – Blake Lovewell

December 2023

Watch here for a conversation on the themes elucidated in the article below:

As we reach the end of 2023 there is brief pause for thought and reflection. In the cryptocurrency sphere there has been tumult, winners, losers and a continued expansion of the full fledged industry. Through crisis and successes we will track the many threads of discourse as well as the key events that occurred. It is important, in our 24 hour news cycle, to be able to take a wider perspective and trace trends to enlighten our perspective for the future.

We would be remiss to begin our summation of 2023 in cryptocurrency without discussing the wider economic context. We witnessed the swingeing return of the controversial ‘i’ word: Inflation. It is something that many will have forgotten about. We have had, until 2020, over a decade of extremely low central bank interest rates. In this environment, economic growth was mainly burned in the central bank furnaces to print money. After the financial crisis of 2008, central banks had been on a money printing spree and by keeping the interest rates low they could offset this printing with the sale of treasuries at low interest rates. There was slow and steady, yet imperceptible, inflation in prices; below the mystical 2% standard promised by central banks. Then, in 2020, most nation states in the world decided to simultaneously enact strict policies of central control. Following the lead of infamous dictatorship China, countries from East to West foamed at the bit to restrict the activity of citizens and businesses. Suddenly small businesses were shuttered and forbidden to open, workers were told to stay home and police drones roamed the streets to monitor the citizenry of the world. This caused a huge economic black hole. There was little to no productivity – only certain large corporations were allowed to trade and remain open, to their own obscene profits. The rest of the global economy was put on an intra-venous drip of easy money. The printing spree turned binge, and the floodgates opened. Through programs such as furlough, the state would support recently imprisoned workers with state money. This government expenditure was funded by an unprecedented purchase of government debt by the central banks, think parents paying off the kids credit cards. For two years there were aggressive restrictions on economic activity and extreme state spending to sustain the economy and prevent total collapse. Now, three years down the line from the instigation of these policies, the chickens came home to roost.

As economies around the world see stagflation, weak growth and economic uncertainty, cryptocurrency as a whole has taken a hit. Its rapacious growth was stemmed in the wake of the collapse of FTX in 2022 and concurrent bank failures in the USA in 2023. This means that easy money has exited the market – the government stipends have dried up and cryptocurrency as one of the beneficiaries of this easy money has taken a hit. The decline, as is a regular trend in cryptocurrency starts at the fringes. Alt-coins, those tiny speculative projects have been hard pressed to find suckers for their schemes. However, even top 10 coins have seen a diminishment. In these hard times people flock to the safest assets, and in cryptocurrency, Bitcoin is king. By the end of 2023 it returned to 50% dominance of the crypto market, having dipped to about 40% at its lowest.

Bitcoin as a hedge

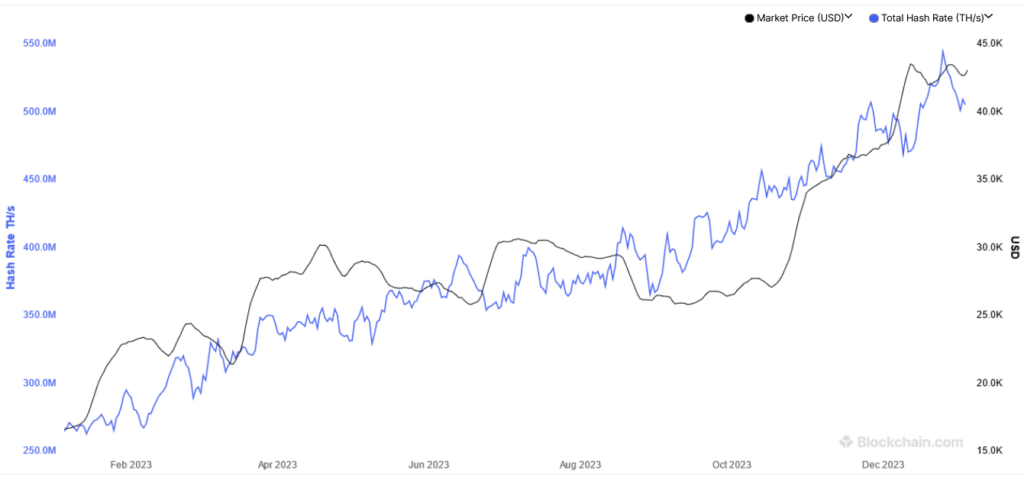

Bitcoin is seen by some as a hedge against inflation and meandering central bank policy. If you hold an asset outside of the Dollar, Pound or Yen, you are insulated from the vagaries of their money printing policy. Whilst Bitcoin had fallen by 50% from its peak in 2021, it made up a lot of ground through 2023. It also gained more resilience. The number of new wallets, which correlates to new users continued to steadily increase. The price in dollar terms increased too, ending the year on around $42,000 per Bitcoin. However, if we are true anarchists, we don’t attend to the price of Bitcoin in dirty fiat, which is only worth the paper it’s printed on. We pay more attention to the market fundamentals of Bitcoin, namely hashrate. The global ‘hashrate’ is the sum total of computing power that is grinding away to solve Bitcoin’s equation and mine a block. This is a measure of people’s confidence in Bitcoin moving forward as investing in mining equipment and energy is expensive – almost out of the realm of the average Joe without lots of spare money. Global hashrate is at an all time high at the end of 2023, meaning miners are confident that Bitcoin will hold its value, or even go much higher, furthermore the network is more secure the more people who mine it so it is a good indicator of the increased health of Bitcoin’s network despite a tumultuous year.

I should mention here: ordinals. I mentioned them earlier in March of 2023 in conversation but they have come to greater prominence, booming in the Winter. An ordinal is a piece of information encoded into a Bitcoin transaction. It exploits a part of Bitcoins fundamental code whereby someone can add information in a Bitcoin transaction, perhaps to signify who the Bitcoin was transmitted to, or for what. Yet canny nerds have managed to use this field to fill with jpeg image codes, music file codes and other piles of information. These little units of information are then traded like NFTs (non-fungible tokens) and as they are on Bitcoin’s main blockchain they garner a lot of interest.

By misusing this information field someone can transmit a transaction of 0.00000001 BTC, the smallest denomination of Bitcoin, and include 2mb of data which would fill a whole block on Bitcoin’s blockchain. We can think of a block mined on Bitcoin’s blockchain as a bus. Usually they come about every 10 minutes, and carry about 10,000 transactions in their 2mb capacity. Thus if I sent you 1 Bitcoin, it would arrive in about 10 minutes, alongside thousands of other transactions. One ordinal with a picture of a cat, however, can totally fill the bus, so my transaction would be stuck at the bus-stop (known as the memory pool) until the next bus in 20 minutes. You can see how the network effect of ordinals can cause a massive clogging of the network and there is currently a war over their usage.

Some mining pools, groups of miners, are disavowing any block with ordinals, so they can filter out the ‘true’ transactions, in their eyes. The trouble is not all pools agree on a set of rules for ordinals. Some other pools support the purist motion that all transactions are equal and no transactions should be censored; otherwise you become the same middlemen bankers and statists that Bitcoin set out to expunge in the first place. We have yet to see the outcome of this debate, but it is an important issue which could rock the foundations of Bitcoin if it induces a change in the base code which hasn’t been touched by hard-fork in about a decade. It is definitely one to watch moving forward.

The Collapsed FTX and the Trial of SBF

FTX rose to prominence in 2021, hitting a million users. It was a cryptocurrency exchange, allowing users to trade and hold crypto. It also offered its own token, FTT, to use as intermediary when trading. It quickly grew from its shady beginnings to a million users, and sponsoring a sports arena before its collapse in 2022.

The shady beginnings I refer to were the ascendency of a small group of MIT alumni to the top of the USA’s political and economic spheres. Obviously, as with most corruption, there is an unhealthy dose of nepotism. Bankman and Fried, Sam Bankman-Fried’s parents were high up Stanford economists. Though they present themselves as having a back-seat role, SBF’s father did help draft legal documents for the creation of Alameda Research in 2017. But perhaps more pertinent is the connection with MIT. Carole Ellison was part of the polycule that instigated FTX. Her father was Gary Gensler’s boss when he worked at MIT. Gensler segued smoothly from his role as economics professor, where he advocated for Ripple; a burgeoning payments technology which just partnered with Mastercard – into his role as head of the Securities Exchange Commission. Thus we have a tight ring between two of the founders of FTX, the movers and shakers at the top of the USA’s universities and the boss of the SEC – the institution in charge of regulating shady financial instruments. Perhaps, I add with dripping sarcasm, this had something to do with the easy ride FTX had through regulation.

That easy ride was verily lubricated by significant political donations. It is not all out in the open as SBF used plenty of obfuscation in donations. We do though know that at his peak SBF donated over $100million in the US mid-terms from FTX users’ deposits. These donations were linked to Senate leaders such as Mitch McConnell and Chuck Schumer. Also infamously he was blown a kiss by Maxine Waters on a visit to the Capitol. To the political establishment’s great chagrin, just months later, FTX would completely collapse. Having funnelled billions of dollars of customer funds into Alameda Research and losing some big gambles, the whole empire became insolvent.

SBF had cannily based his company in the Bahamas, ensuring a nice safe haven for their business activities. Thus after the collapse, SBF was holed up in the Bahamas and it took some machinations to get him back to the USA to face a jury. 2023 would see the fallen SBF attend trial in the USA on charges including fraud, wire fraud and conspiracy. He was released to his parents multi-million dollar property on bail; set at $250 million, the largest ever bail bond. Although in July 2023, after being caught witness tampering, he was remanded in prison.

During the trial, which mostly focussed on the illicit credit lines between Alameda Research, the shady trading venture, and FTX, the cryptocurrency empire. SBF would claim ignorance of much of the activities which took place on his watch and in his name. Countless billions of dollars of customers’ money were though accounted for and traced into the black hole, estimates start at the $8 billion mark. Similarly many of the political donations would lead straight into the ether and, usefully for US politicians, fall outside the remit of the trial. In fact the campaign donations violation charge was dropped from the docket at the behest of the Bahamas. They would not extradite SBF on that charge, we presume due to US political pressure.

One aspect of corruption ongoing is the return of customer funds. Autism Capital, a crypto researcher, claims that user funds are being returned at the lower dollar value from 2 years ago whilst FTX’s legal team are able to sell the underlying asset off at 4 times the market value and pocket the difference. He also highlights the deliberately weak coverage of SBF’s campaign funding violation trial – whereby the political dimension of corruption could be revealed.

Addendum: Fortunately I waited until the very last day of the year to finish this article. We are presented with the news today that whilst SBF was found guilty on 7 charges earlier in 2023, that the second trial, for 5 more charges including unlawful campaign contributions, would be dropped. The Department of Justice claim they have already seen much of the evidence and that the case should be dropped in the interest of expediency. We can therefore conclude that the SBF case exemplifies the corruption of the US political class of today. There is an open door between regulators and corrupt actors to ensure that predatory financial corporations are allowed to victimise customers with no oversight or prevention. It also highlights how the politicians themselves are owned by their donors, be they economic such as SBF, or military such as Nikki Hayley being on the board of Boeing, I digress.

Regulation

As aforementioned, the job of regulating crypto in the USA seems to fall unto the SEC. The SEC was created in the shadow of the Wall Street crash. FDR was on a spate of alphabet agency creation; this agency was to protect investors from the exigencies of high-risk financial schemes. However, as with most regulation bodies they become co-opted by the groups whose behaviour they should be curtailing and often become toothless pawns. The case of SBF, Gensler and the SEC demonstrates this – and Gensler’s role is still under some scrutiny. However, there is much political lobbying for cryptocurrency and related industries to fall under the remit of the CFTC: the Commodity Futures Trading Commission. They are similarly poised to regulate, in particular, speculative investment devices – such as stock investment. They also are seeking to bring crypto under their wing by expanding their purview. Throughout 2023, the US Senate have held a commission on this expansion of CFTC’s role in regulating cryptocurrency as well as the burgeoning carbon credit markets.

A second and vitally important arena of regulation to mention is ETFs. An ETF, an Exchange-traded Fund is a financial instrument that people can buy or sell in a similar way to a stock or share. Some ETFs are bundles of shares held by a company. ETFs are pertinent here because a number of the biggest investment firms in the world are vying to create a Bitcoin spot ETF. This would be tied to the price of Bitcoin – it would be a bet on if you think the price of Bitcoin would go up or down. An ETF allows people to participate in the hype around Bitcoin without the regulatory jamboree of buying and taking the actual asset into self-custody.

The SEC is currently the institution that regulates ETFs and given the huge upside potential, they are the prime target for lobbying. Blackrock, the biggest asset holder in the world, is in prime position to push out their Bitcoin spot ETF in 2024, which would have a massive price on Bitcoin itself. If the ETF sold too much at a certain price, there would be an incentive to hold Bitcoin’s market value either higher or lower, leading to market manipulation. Therefore if Blackrock, a massive asset holder, can run a worldwide bet on Bitcoin’s price they can effectively manipulate the price. Tie that in with malicious actors in the sphere who have other interests and you can see potential for market rigging on a large scale. As Max Keiser points out, the only solution to the burgeoning ETF market is for deep-pocketed investors to begin picking up vast quantities of underlying Bitcoin itself to ensure the asset remains in public hands. As yet we still await these angel investors appearance.

El Salvador – Bitcoin country

We cannot bring up the arch-maximalist Max Keiser, formerly of RT, without mentioning his side venture, as economic adviser to El Salvadorian president Nayib Bukele. El Salvador has seen something of a tidal shift in the last few years. Nayib Bukele, a mild populist leader, managed to pull back some power from the omnipresent USA in El Salvador. The country had been plagued by gang violence as the hub for the notorious MS-13 gang. Many gang members were forcefully extradited from US prisons into El Salvador, causing a wave of criminality. Bukele came into power, apparently mild-mannered but behaved as a strong-man. Strict regimes of policing were created and he has cut El Salvadorian crime to a huge degree. It has gone from the most dangerous countries in the Americas, with shootings every day, to one of the safest with months with no violent crime at all. His policies have not been without detractors, as humanitarian charities have challenged his imprisonment of so many gang members, but his approval ratings are high.

In parallel with the crime crackdown, Bukele introduced Bitcoin to El Salvador. With Keiser by his side, he went further in adoption of Bitcoin than any State leader has to this point. Not only did he adopt Bitcoin as legal tender / currency, as other states already have, he also invested central bank funds in Bitcoin, making El Salvador itself a big holder of Bitcoin. Furthermore he established a Bitcoin wallet for Salvadoreans and gave every citizen a stipend of about a week’s wages in Bitcoin. Whilst it has only been a qualified success with low usage of the wallet, El Salvador has seen a growth in GDP whilst many South American countries have seen a fall or stagnation. Furthermore El Salvador are on the brink of launching their own volcano powered mining operation and bond scheme to allow foreign investment into the ‘Bitcoin nation’. There is also blooming interest in Arab Gulf states in Bitcoin, with rumours abounding about their possible entrance into the sphere. If a Saudi Arabia or Qatar began moving their central bank funds into Bitcoin, we would see a ‘God Candle’ and it would move the legitimacy of Bitcoin to a much higher level. Whilst this is great cause for optimism for Bitcoin’s price, we must always balance that by saying no official statement has been made formally.

In Other News

The cryptocurrency sphere is huge. It used to fit mainly inside one forum, bitcointalk.org which was the hub for all cryptocurrency for the early years. Nowadays there are hundreds of full-time publications, each churning out high-end analyses of the cryptocurrency market. The cryptocurrency market is rated at a value of over $1trillion. There are thousands of coins, tokens and products constantly innovating, some shorter lived than a damsel-fly. Plus we have the growing acceptance of institutions around the world who flex and adapt to the new landscape and evolve regulation in tandem with innovation. Thus it is an impossible task to give a deep dive on crypto in one article. But I have picked out some more salient trends, ones to watch for the new year – which should give a little gestalt, a sprinkling of pixels from the bigger picture view.

The first is the case of Binance. Binance is the biggest cryptocurrency exchange in the world; it has its own token, BNB, used for billions of dollars of trading each year. They have always skirted the fringe of regulation, locating offices in various Caribbean and Asian islands and hopping jurisdictions regularly. This year, the USA caught up with Binance and launched a class-action lawsuit. Binance had encouraged American users to use proxy servers to access their services and skirt US controls on crypto. This ended up with Binance paying billions to the USA, and their CEO stepping down. This indicates a big win for US regulation as they have poached one of the bigger sharks in the sphere.

Binance falling to the regulators may in the long term spell the end of Binance itself, as they have a lot of shady business going on in the background. As with any crypto exchange there are accusations of market manipulation and the bending of international laws is not always well received. The intense oversight and scrutiny also puts the stopper on many of their activities. One important point for me is the regulation of privacy coins. Privacy coins, like Monero and to a lesser extent Zcash, allow users to interact and transact privately. Even though their blockchain is public, there is no way to decipher who is transacting, how much, and when. This allows for people to evade censorship, and state control. Obviously the success of these technologies is a massive thorn in the side of global power structures who seek to control as much as possible the lives of the people. This is pertinent to the Binance case as Binance has been pressured to drop Zcash and Monero from their exchange by US regulators. It is not the first time that Monero for example has been dropped from exchanges for fear of regulation, but it indicates a step further in the battle of the State vs. Privacy technologies. We note too the US government’s Luddite attempts to make any type of encryption illegal. It is a battle worth watching as these privacy technologies usually keep ahead of government regulation – Monero doesn’t require Binance to function, it is designed to be peer-to-peer and fully decentralised, and continues to grow.

Another one to watch is Tether. Tether is the biggest stablecoin. A stablecoin is a token that is tied to the price of a currency, in this case, the US Dollar. Because 1 USDT (Tether’s token name) is worth 1 US Dollar, people can arbitrage their cryptocurrencies virtually with something that resembles a digital dollar. This is important for a variety of reasons. Firstly, the USA along with all other developed nations, have been working to create a fully digital version of their currencies, this allows for greater control and scrutiny over transactions. You can look into my other articles on CBDCs (Central Bank Digital Currencies) for a much deeper dive on this topic. Another aspect of the Tether story though, is that it has to back its digital token with ‘real-world’ assets. The way they choose to do so is by buying US treasuries. These are certificates issued by the USA at a certain interest rate – the state will pay the bearer a fixed interest rate over a fixed time period, for example a 2-year treasury might earn you 2% interest when it matures. The trouble for the US treasury in 2023 is that they have burned up most of their street credibility. Most people don’t believe that the US have the power to ensure the dollar is worth similar or more on a 2, 5 or 10 year period. This is due to 2 things: the first is that in sanctioning Russia, the USA said they would not honour any treasuries held by the Russian state, thereby defaulting on the debt and losing face. Secondly, the Federal Reserve has had trouble throughout 2023 in keeping inflation under control and looks weak. This means that having a buyer like Tether, who must buy treasuries to remain liquid, and back their ever expanding book of assets, is very important. Some commentators think that Tether is one of the few backstops propping up the US treasury market and ensuring the USA doesn’t publically default on its debt.

As we can see, in just a few years Tether have become a linchpin for the US economy and show no signs of slowing. Their biggest competitor, USDC, another stablecoin, lost the faith of the markets as it was tied in with Signature bank, which went down in the flames of the FTX fiasco. Tether is cemented as number 1 for now. But I believe that, similarly to Binance, its days are numbered. They too have a history of negligent behaviours and an opaque operating procedure. They refused to be properly audited for many years and even now, many don’t believe their accounting. They are also tied into multiple complaints of price manipulation with Bitcoin. There is an open case in court declaring that Tether issued USDT and bought up cheap Bitcoin on the news, thereby manipulating the price and garnering huge private profits – this is market rigging.

Furthermore, in November 2023, Tether was caught in the ‘Authorised, not minted’ scandal. Here they ‘authorised’ the creation of $1billion of USDT on Christmas Day, but didn’t mint it directly into tokens and release it to the public. Instead they held it in reserve, but the authorisation itself caused a huge pump in Bitcoin price. Anybody with advance knowledge of the authorisation could stand to make huge profits in another case of market manipulation, and it seems on statistical analysis that certain actors did. Whether this too will be borne out in a court case, we are yet to see but it is indeed shady behaviour from a huge player in the crypto space. A worrying sign no less.

I would go as far as to say that Tether is the test case for future stablecoin technology. Not only does USDT help the US government and operate as a middleman in cryptocurrency trading, but it operates as a functional currency in states where the local currency is untrustworthy. In Lebanon for example, the central bank defaulted on its debts and effectively became bankrupt. The Lebanese Pound became useless as a currency with its value in freefall, so USDT, Tether, became one of the fallback currencies. It’s certainly an interesting time for financial innovation, but I implore people to be wary of technologies presented as ‘the next best thing’ or which seem extremely convenient as they may be masking inhumane profit-seeking motives, as I believe Tether do.

Do look out in the new year for the threads unravelling from some of the small tears in the tapestry I have highlighted here. For those of us who are interested in crypto – these times are enjoyable and worrying in equal measure. As for predictions, we can only go on what we have seen so far, and that is a rollercoaster of ups and downs, a myriad of controversies and always a rogue actor lurking in the shadows. Similarly there are huge causes for cautious optimism, the resilience of the cypherpunk ideology is heartening, so too is the slow pace of institutional progress to deal with the new era of finance in cryptocurrency. It is worth reminding you, lastly, of the old maxims of crypto: ‘Trust no-one, Do Your Own Research’, ‘Hodl – to the moon’ and ‘Not your keys, not your coins’. Perhaps these could be a new year’s resolution if you are still looking for one.

Sources:

BBC, March 202: State will fund 80% of workers wages

https://www.bbc.co.uk/news/business-51982005

Coinmarketcap: Bitcoin 2023 statistical summary including market dominance

https://coinmarketcap.com/academy/article/a-visual-look-back-on-bitcoin-in-2023

Ordinals: An example of a Bitcoin Ordinal: Bitcats Inscription #312037

https://gamma.io/inscription/f68560d5aa1c8022ed2ca50932c83f39ef17a9cca7f00e6a204dd39df220ba2ei0

Bankman, father, drafts legal documents for Alameda

Gensler at MIT advocates for Ripple, with Ellison as boss

Ripple partners with Mastercard to offer blockchain products

https://coinpedia.org/news/ripple-news-xrp-goes-mainstream-mastercard-integration-unveiled/

SBF donates $100 million during US mid-terms

https://nitter.net/CollinRugg/status/1741100200465183034

SBF campaign donation violation charge dropped due to Bahamas

Autism Capital: User funds returned at low rate from FTX case

https://nitter.net/AutismCapital/status/1740924608134693129

Rumours of Qatar’s $500 billion entry into Bitcoin

Blake Lovewell: The 7 Pillars of a Global CBDC system

Tether in court over Bitcoin price rigging

Tether: ‘Authorised not minted’ scandal

https://cryptodaily.co.uk/2023/12/tether-ceo-announces-1b-usdt-mint-authorized-not-issued

1,872 responses to “The State of Cryptocurrency in 2023”

У нас можно купить брендовые товары от бренда Gucci . Коллекция включает одежду и аксессуары , для самых изысканных покупателей.

https://boutique.gucci1.ru

Hi! Do you know if they make any plugins to assist with SEO?

I’m trying to get my site to rank for some targeted keywords but I’m not seeing very

good success. If you know of any please share. Thank you!

I saw similar article here: Blankets

By implementing these methods, we will work in direction of reducing mental well being stigma and making a society that helps the psychological effectively-being of all individuals.

Aw, this was a really nice post. Finding the time and actual effort to produce a good article… but what can I say… I hesitate a lot and never manage to get nearly anything done.

Hello there! I simply want to offer you a big thumbs up for the great info you have here on this post. I am returning to your web site for more soon.

Hi there! I could have sworn I’ve visited this site before but after going through some of the posts I realized it’s new to me. Nonetheless, I’m definitely pleased I stumbled upon it and I’ll be bookmarking it and checking back frequently.

Good post. I learn something totally new and challenging on blogs I stumbleupon on a daily basis. It will always be useful to read articles from other authors and practice something from their web sites.

bookmarked!!, I love your web site.

This practice, generally known as “redlining,” persisted through the 1960s, conserving residence ownership out of attain of most Black Individuals.

Everything is very open with a clear explanation of the issues. It was really informative. Your site is very useful. Many thanks for sharing!

Patricia Prieto has been a huge title in Philippine trend ever since she began her blog Paradigma in 2009.

When he regarded to the long run, Grayson Hart always noticed a college degree.

As a result of so much of selling is now completed on-line, the transition from an in-particular person internship to a digital internship is sort of simple-making advertising and marketing certainly one of the preferred forms of virtual internships.

After checking out a handful of the blog articles on your site, I really like your technique of writing a blog. I saved it to my bookmark site list and will be checking back soon. Take a look at my website as well and tell me what you think.

Can I just say what a relief to uncover someone who truly knows what they’re talking about online. You actually know how to bring a problem to light and make it important. A lot more people should check this out and understand this side of your story. I was surprised that you are not more popular given that you definitely have the gift.

Greetings! Very useful advice in this particular post! It’s the little changes that make the largest changes. Thanks a lot for sharing!

This is a topic that’s close to my heart… Thank you! Exactly where are your contact details though?

Hi there, I do think your website could possibly be having web browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in I.E., it has some overlapping issues. I just wanted to give you a quick heads up! Other than that, wonderful website.

Hi! I just want to offer you a huge thumbs up for the great info you have got here on this post. I will be returning to your blog for more soon.

bookmarked!!, I love your website!

I recently occupied this site to allot https://synergy3.com/plumbing/gas-piping/ , and I couldn’t be happier with the results. The search was straightforward, and I appreciated the ornate profiles and patron reviews instead of each contractor. It made comparing options and reading wide other clients’ experiences easy. The contractors I contacted were prompt, trained, and offered competitive quotes. This position is a spectacular resource seeing that anyone needing trusty home repair services. Highly recommended payment its user-friendly interface and eminence listings!

I wanted to thank you for this very good read!! I definitely enjoyed every little bit of it. I have got you saved as a favorite to look at new things you post…

There’s definately a lot to know about this topic. I really like all the points you’ve made.

I could not resist commenting. Exceptionally well written.

Everything is very open with a clear clarification of the challenges. It was really informative. Your website is very helpful. Thanks for sharing.

After looking over a few of the articles on your website, I honestly like your way of writing a blog. I added it to my bookmark website list and will be checking back in the near future. Please visit my web site as well and let me know your opinion.

bookmarked!!, I love your blog.

Hey there! I simply would like to give you a huge thumbs up for your great info you have got right here on this post. I’ll be coming back to your website for more soon.

Learning Spanish isn’t just about mastering a bunch of phrases; it’s more like opening a window to a complete new world where you get to communicate with the wonderfully different folks out there, and due to this fact, gain a recent perspective on life.

An intriguing discussion is definitely worth comment. I think that you need to write more about this subject, it might not be a taboo subject but typically people do not talk about such issues. To the next! All the best!

By 1838, the Cherokee had run out of legal options in resisting elimination.

I love it when people get together and share ideas. Great site, stick with it.

I have to thank you for the efforts you’ve put in writing this site. I am hoping to view the same high-grade content from you later on as well. In truth, your creative writing abilities has encouraged me to get my own, personal blog now 😉

After looking over a number of the blog posts on your site, I honestly appreciate your technique of blogging. I saved as a favorite it to my bookmark webpage list and will be checking back soon. Please visit my website as well and tell me how you feel.

May I simply say what a relief to find an individual who really understands what they are talking about online. You certainly understand how to bring an issue to light and make it important. A lot more people ought to check this out and understand this side of the story. It’s surprising you aren’t more popular because you surely have the gift.

You’re so cool! I don’t believe I’ve truly read a single thing like this before. So nice to find somebody with some unique thoughts on this issue. Really.. many thanks for starting this up. This site is something that is needed on the internet, someone with a bit of originality.

Burial will comply with in Centenary Cemetery.

You made some decent points there. I checked on the net for additional information about the issue and found most individuals will go along with your views on this web site.

Many issues affect how properly a pump works, starting with good hydraulics.

This excellent website definitely has all the information I needed concerning this subject and didn’t know who to ask.

I couldn’t refrain from commenting. Perfectly written.

Right here is the perfect site for anybody who wants to find out about this topic. You know so much its almost tough to argue with you (not that I personally will need to…HaHa). You definitely put a brand new spin on a topic that has been written about for many years. Wonderful stuff, just excellent.

This was adopted up three more clean sheets in the following three league matches.

I truly love your site.. Pleasant colors & theme. Did you create this web site yourself? Please reply back as I’m hoping to create my very own website and would love to know where you got this from or what the theme is named. Many thanks.

I absolutely love your website.. Very nice colors & theme. Did you build this website yourself? Please reply back as I’m hoping to create my own website and want to know where you got this from or just what the theme is called. Kudos.

Tammy Less of Omaha received her father’s autopsy report Thursday, per week after his funeral and the day Iowa health officials announced the state’s first human West Nile case and the second West Nile dying in the nation this season.

Aw, this was an exceptionally nice post. Taking the time and actual effort to produce a top notch article… but what can I say… I hesitate a lot and never manage to get nearly anything done.

Hey! I could have sworn I’ve been to this site before but after reading through some of the post I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be book-marking and checking back frequently!

I absolutely love your blog.. Excellent colors & theme. Did you build this amazing site yourself? Please reply back as I’m attempting to create my own personal blog and want to know where you got this from or just what the theme is named. Kudos!

I quite like looking through an article that can make people think. Also, thank you for permitting me to comment.

You need to be a part of a tournament first of the most useful blogs on-line. I will suggest this website!

Way cool! Some extremely valid points! I appreciate you penning this article and also the rest of the website is very good.

I and also my guys were actually digesting the great tips and tricks located on your website while immediately came up with a horrible feeling I had not thanked the web site owner for them. These boys happened to be so joyful to learn them and now have surely been taking pleasure in these things. We appreciate you being really kind and for settling on certain extraordinary subject matter millions of individuals are really wanting to be informed on. Our own honest apologies for not expressing appreciation to you earlier.

An outstanding share! I’ve just forwarded this onto a friend who was doing a little homework on this. And he in fact ordered me dinner simply because I found it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanks for spending some time to discuss this topic here on your web site.

Well done! I thank you your contribution to this matter. It has been useful. my blog: cityville cheats

Hello there! This post couldn’t be written much better! Reading through this post reminds me of my previous roommate! He constantly kept talking about this. I will send this post to him. Pretty sure he’ll have a great read. Many thanks for sharing!

Greetings! Very helpful advice within this post! It is the little changes that will make the most important changes. Thanks for sharing!

Enjoyed examining this, very good stuff, thanks .

Strong blog. I acquired a lot of great information. I?ve been keeping an eye on this technology for some time. It?utes fascinating the manner it retains different, nevertheless a number of of the primary parts stay a similar. have you ever observed lots modification since Search engines created their own latest purchase in the field?

A good clear cut answer and a great concept. But how do I post any work on this website is another question. The Foureyed Poet.

After checking out a number of the articles on your site, I honestly appreciate your way of writing a blog. I bookmarked it to my bookmark site list and will be checking back soon. Take a look at my web site too and let me know your opinion.

You, my pal, ROCK! I found just the information I already searched all over the place and just could not locate it. What a perfect web site.

From now on, it could be a swell idea to make up with a additional entry to this. Many people want to look at this and will wait for it.

you use a fantastic blog here! want to make some invite posts on my blog?

Oh my goodness! a wonderful article dude. Thanks a ton Nevertheless We are experiencing problem with ur rss . Don’t know why Struggle to register for it. Possibly there is anyone finding identical rss problem? Anybody who knows kindly respond. Thnkx

Very good post! We are linking to this particularly great content on our website. Keep up the good writing.

This page certainly has all the information I needed concerning this subject and didn’t know who to ask.

Sometimes your blog is loading slowly, better find a better host..-,~”

you possess a excellent blog here! do you wish to make some invite posts on my blog?

Well, the article is really the freshest on this notable topic. I agree with your conclusions and will certainly thirstily look forward to your approaching updates. Saying thanks definitely will not just be acceptable, for the excellent clarity in your writing. I will promptly grab your rss feed to stay privy of any updates. Pleasant work and also much success in your business efforts!

I would like to express appreciation to you just for bailing me out of this particular difficulty. As a result of looking out throughout the internet and seeing notions that were not beneficial, I was thinking my entire life was over. Being alive devoid of the answers to the issues you have solved by means of the guide is a serious case, as well as those that might have badly damaged my career if I hadn’t noticed the blog. The know-how and kindness in controlling all the things was very helpful. I am not sure what I would’ve done if I had not discovered such a subject like this. It’s possible to at this time look forward to my future. Thanks for your time very much for your professional and sensible guide. I won’t think twice to propose your web blog to any person who requires counselling about this subject. visit here – alternative medicine

eating disorders are of course sometimes deadly because it can cause the degeneration of one’s health.,

Good post. I learn something totally new and challenging on sites I stumbleupon every day. It’s always interesting to read articles from other writers and practice a little something from their web sites.

Good day! I could have sworn I’ve visited this blog before but after going through a few of the articles I realized it’s new to me. Anyways, I’m definitely happy I stumbled upon it and I’ll be book-marking it and checking back regularly.

Limitless is a fun ride all the way through and it’s visually striking to boot.

hello!,I love your writing very much! share we keep up a correspondence extra approximately your post on AOL? I require an expert in this area to resolve my problem. May be that is you! Having a look forward to see you.

I’d have got to talk with you here. Which is not some thing It’s my job to do! I enjoy reading a post that can get people to believe. Also, thank you for permitting me to comment!

Spot on with this write-up, I absolutely feel this website needs a lot more attention. I’ll probably be returning to read more, thanks for the info.

Simply wanna tell that this is very beneficial, Thanks for taking your time to write this.

Some times its a pain in the ass to read what website owners wrote but this site is rattling user pleasant! .

Good post. I study one thing more challenging on totally different blogs everyday. It is going to all the time be stimulating to learn content material from different writers and observe a bit of one thing from their store. I prefer to make use of some with the content material on my blog whether you don’t mind. Natually I provide you with a hyperlink in your web blog. Thanks for sharing.

I’d ought to talk to you here. Which is not something It’s my job to do! I enjoy reading an article which will get people to believe. Also, appreciate your permitting me to comment!

When I originally commented I clicked the -Notify me when new surveys are added- checkbox now every time a comment is added I receive four emails with the same comment. Is there that is you may get rid of me from that service? Thanks!

After checking out a handful of the blog posts on your website, I seriously like your technique of blogging. I saved it to my bookmark site list and will be checking back soon. Please visit my web site as well and tell me how you feel.

pay per click programs are really great, i could earn some decent cash from it**

Have you ever considered publishing an e-book or guest authoring on other sites? I have a blog based upon on the same subjects you discuss and would really like to have you share some stories/information. I know my readers would value your work. If you are even remotely interested, feel free to shoot me an email.

Binary options has become increasingly popular. Tradesmarter is one of the oldest binary options trading platform and is regulated as well.

241) (quoting Dan Heisman).

He married Ina Mae ESTLE, Sept.

An impressive share! I’ve just forwarded this onto a co-worker who had been conducting a little homework on this. And he actually bought me dinner simply because I discovered it for him… lol. So let me reword this…. Thank YOU for the meal!! But yeah, thanx for spending some time to talk about this topic here on your internet site.

I’m impressed, I must say. Truly rarely do I encounter a weblog that’s both educative and entertaining, and let me tell you, you have hit the nail around the head. Your concept is outstanding; the problem is an element that insufficient persons are speaking intelligently about. We are delighted we stumbled across this around my look for something concerning this.

This design is incredible! You definitely know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job. I really loved what you had to say, and more than that, how you presented it. Too cool!

I definitely wanted to post a simple remark in order to thank you for all the unique tips and tricks you are giving out on this website. My incredibly long internet search has finally been recognized with extremely good points to go over with my company. I ‘d say that we readers are very blessed to exist in a superb site with so many awesome people with good advice. I feel pretty happy to have come across your entire website and look forward to tons of more brilliant moments reading here. Thanks a lot once more for everything.

Greetings! Very useful advice in this particular post! It’s the little changes which will make the biggest changes. Thanks a lot for sharing!

I just put the link of your blog on my Facebook Wall. very nice blog indeed.~~`:`

When I originally commented I clicked the -Notify me when new comments are added- checkbox now if a comment is added I get four emails sticking with the same comment. Is there however you can eliminate me from that service? Thanks!

Keep up the wonderful piece of work, I read few content on this web site and I believe that your web blog is real interesting and has got circles of great info .

What i don’t understood is in fact how you’re not really a lot more neatly-appreciated than you may be right now. You are very intelligent. You realize thus significantly in relation to this matter, produced me individually believe it from numerous varied angles. Its like men and women don’t seem to be interested until it is something to do with Lady gaga! Your individual stuffs nice. At all times deal with it up!

Hey there this is a fantastic article. I’m going to e mail this to my buddies. I stumbled on this while browsing on google I’ll be sure to come back. thanks for sharing.

It’s difficult to acquire knowledgeable people about this topic, but the truth is be understood as there’s more you’re referring to! Thanks

I used to be able to find good info from your blog articles.

Chew was raised in a Quaker household, however he broke with Quaker tradition in 1741, when he agreed along with his father, who had instructed a grand jury in New Castle, Delaware on the lawfulness of resistance to an armed force.

I’d need to seek advice from you here. Which is not something I usually do! I love reading an article that will make people feel. Also, many thanks permitting me to comment!

Excellent article! We will be linking to this great article on our website. Keep up the good writing.

I’d like to thank you for the efforts you have put in writing this website. I am hoping to view the same high-grade blog posts from you in the future as well. In truth, your creative writing abilities has encouraged me to get my own, personal blog now 😉

Good information. Lucky me I ran across your site by chance (stumbleupon). I have book marked it for later!

3. Recognizing that game design is an organic course of.

Greetings! Very helpful advice in this particular article! It’s the little changes that produce the biggest changes. Thanks a lot for sharing!

A gaggle of American artwork consultants – together with James Flexner – have been invited to Mount Vernon round 1966 to study the many household portraits owned by George Washington.

I used to be able to find good advice from your content.

This really is a marvelous post. Thanks for bothering to explain this all out for all of us. It is a great guide!

Oh my goodness! an incredible article dude. Thank you However I am experiencing situation with ur rss . Don’t know why Unable to subscribe to it. Is there anyone getting an identical rss problem? Anyone who knows kindly respond. Thnkx

I also believe so , perfectly indited post! .

This is a great tip particularly to those fresh to the blogosphere. Simple but very accurate info… Many thanks for sharing this one. A must read article.

Great – I should definitely say I’m impressed with your blog. I had no trouble navigating through all the tabs and related info. It ended up being truly simple to access. Great job…

After study a few of the content on your own website now, and i also truly as if your strategy for blogging. I bookmarked it to my bookmark site list and you will be checking back soon. Pls look into my internet site as well and told me what you think.

Oh i really envy the way you post topics, how i wish i could write like that.’:\’`.

Oh my goodness! Awesome article dude! Thanks, However I am experiencing difficulties with your RSS. I don’t know why I cannot subscribe to it. Is there anybody getting identical RSS problems? Anyone who knows the answer will you kindly respond? Thanx!!

This is the right site for everyone who hopes to understand this topic. You realize so much its almost tough to argue with you (not that I actually would want to…HaHa). You definitely put a brand new spin on a subject which has been discussed for years. Excellent stuff, just excellent.

Your style is really unique compared to other people I’ve read stuff from. Thanks for posting when you have the opportunity, Guess I’ll just bookmark this page.

I’m amazed, I have to admit. Rarely do I come across a blog that’s both equally educative and entertaining, and let me tell you, you’ve hit the nail on the head. The problem is something too few men and women are speaking intelligently about. I am very happy I came across this during my hunt for something relating to this.

very good put up, i definitely love this web site, keep on it

I’m thinking some of my readers might find a bit of this interesting. Do you mind if I post a clip from this and link back? Thanks.

Oh my goodness! Awesome article dude! Many thanks, However I am having problems with your RSS. I don’t understand why I am unable to subscribe to it. Is there anybody else having similar RSS problems? Anybody who knows the solution can you kindly respond? Thanks!

I do think, an attempt and even gaffe in their life it isn’t just not doing anything a good deal more glorious daily life, coupled with suggestive.

Nice post. I was checking constantly this blog and I am impressed! Very useful information specifically the last part I care for such information a lot. I was seeking this particular information for a long time. Thank you and best of luck.

We hope this training and content material brings you a whole lot of worth.

Excellent post! We will be linking to this particularly great content on our site. Keep up the good writing.

Throughout the grand scheme of things you secure an A for effort and hard work. Where you lost me personally ended up being on the specifics. As as the maxim goes, the devil is in the details… And it could not be more correct right here. Having said that, permit me inform you what did do the job. Your text is pretty engaging and that is possibly the reason why I am making the effort in order to comment. I do not make it a regular habit of doing that. Second, although I can certainly notice the jumps in reason you make, I am not really confident of how you appear to unite your ideas that help to make the actual final result. For the moment I will yield to your position but trust in the future you link your dots better.

After looking at a few of the articles on your website, I seriously like your technique of blogging. I added it to my bookmark website list and will be checking back soon. Take a look at my web site too and tell me what you think.

Strange this put up is totaly unrelated to what I used to be searching google for, but it surely was indexed at the first page. I guess your doing one thing right if Google likes you sufficient to put you at the first web page of a non similar search.

Part of Rev. 12:9—the Devil, and Satan, which deceiveth the whole world—.

Greetings! Very useful advice in this particular post! It’s the little changes that will make the most important changes. Many thanks for sharing!

This site truly has all the information and facts I wanted concerning this subject and didn’t know who to ask.

They transmit microwave signals, which can journey lengthy distances unlike conventional wireless phones.

An intriguing discussion is worth comment. I do think that you ought to write more about this issue, it might not be a taboo matter but usually people do not discuss these subjects. To the next! Best wishes!

I want to to thank you for this great read!! I certainly loved every bit of it. I have got you saved as a favorite to check out new stuff you post…

I really like it when individuals come together and share views. Great website, continue the good work!

I’m impressed, I must say. Seldom do I come across a blog that’s equally educative and entertaining, and let me tell you, you have hit the nail on the head. The issue is something which too few folks are speaking intelligently about. Now i’m very happy I came across this during my hunt for something concerning this.

To coincide with Mental Well being Consciousness Day, I wanted to share my personal story.

Oh my goodness! Impressive article dude! Thanks, However I am having problems with your RSS. I don’t understand the reason why I can’t subscribe to it. Is there anyone else having similar RSS issues? Anyone who knows the answer will you kindly respond? Thanks!!

Very nice article. I certainly appreciate this website. Continue the good work!

These three quick notes are seen in the coaching stage, and assist to introduce primary gameplay mechanics to the participant.

Hi there, I do think your web site may be having browser compatibility issues. Whenever I take a look at your web site in Safari, it looks fine however, when opening in IE, it’s got some overlapping issues. I merely wanted to provide you with a quick heads up! Besides that, great site.

Survivors embrace a sister, Mrs.

When I originally left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and now every time a comment is added I get four emails with the exact same comment. Is there a way you are able to remove me from that service? Thanks a lot.

FREE parking. Many motel options close to the I-ninety five exit.

Hello! I could have sworn I’ve been to this website before but after browsing through many of the articles I realized it’s new to me. Nonetheless, I’m certainly pleased I discovered it and I’ll be book-marking it and checking back regularly!

Right here is the right webpage for anyone who wants to understand this topic. You understand so much its almost hard to argue with you (not that I personally will need to…HaHa). You certainly put a new spin on a topic that’s been discussed for ages. Wonderful stuff, just excellent.

Aw, this was an exceptionally nice post. Finding the time and actual effort to create a great article… but what can I say… I put things off a lot and never seem to get anything done.

An interesting discussion is worth comment. I think that you ought to publish more about this topic, it might not be a taboo subject but generally people don’t discuss these subjects. To the next! Cheers.

You made some really good points there. I checked on the net to find out more about the issue and found most individuals will go along with your views on this site.

After looking at a few of the blog articles on your web site, I really appreciate your technique of blogging. I book marked it to my bookmark webpage list and will be checking back soon. Take a look at my website as well and tell me what you think.

Good web site you have got here.. It’s hard to find high quality writing like yours these days. I seriously appreciate people like you! Take care!!

May I just say what a relief to find a person that really understands what they’re discussing on the web. You definitely realize how to bring an issue to light and make it important. A lot more people have to look at this and understand this side of your story. I was surprised that you’re not more popular since you definitely have the gift.

You’re so interesting! I don’t suppose I have read through a single thing like that before. So great to discover someone with unique thoughts on this topic. Seriously.. thank you for starting this up. This web site is something that’s needed on the web, someone with a little originality.

Hi there! I just would like to give you a big thumbs up for the great information you’ve got here on this post. I will be coming back to your blog for more soon.

Hello there! This blog post could not be written much better! Looking at this post reminds me of my previous roommate! He constantly kept talking about this. I will forward this post to him. Pretty sure he will have a very good read. Thank you for sharing!

I’m impressed, I must say. Seldom do I come across a blog that’s both educative and amusing, and without a doubt, you’ve hit the nail on the head. The problem is something that too few people are speaking intelligently about. Now i’m very happy that I found this during my hunt for something concerning this.

Everything is very open with a precise clarification of the challenges. It was really informative. Your website is very useful. Thanks for sharing.

I like it when individuals get together and share views. Great blog, stick with it!

You are so cool! I do not think I’ve read anything like that before. So great to find someone with some original thoughts on this issue. Seriously.. thanks for starting this up. This website is something that’s needed on the web, someone with a little originality.

You should be a part of a contest for one of the best websites online. I will recommend this blog!

Hi there! This article could not be written any better! Looking at this post reminds me of my previous roommate! He continually kept preaching about this. I am going to send this information to him. Fairly certain he’s going to have a very good read. Thank you for sharing!

Everything is very open with a precise explanation of the issues. It was really informative. Your site is very useful. Thanks for sharing.

I’m excited to find this page. I want to to thank you for your time just for this wonderful read!! I definitely liked every little bit of it and i also have you saved to fav to look at new stuff on your website.

Oh my goodness! Awesome article dude! Thanks, However I am encountering problems with your RSS. I don’t know the reason why I cannot subscribe to it. Is there anybody else having similar RSS issues? Anybody who knows the solution will you kindly respond? Thanx.

Your style is very unique compared to other people I’ve read stuff from. I appreciate you for posting when you have the opportunity, Guess I will just book mark this blog.

This is a topic that is close to my heart… Many thanks! Exactly where are your contact details though?

Watch our exclusive Neerfit sexy bf video on neerfit.co.in.

I needed to thank you for this good read!! I definitely enjoyed every little bit of it. I’ve got you book-marked to check out new things you post…

A flunked steroid check triggers an automatic 50-game suspension without pay.

Next time I read a blog, Hopefully it does not fail me as much as this one. After all, Yes, it was my choice to read, but I genuinely believed you would have something helpful to say. All I hear is a bunch of crying about something you can fix if you weren’t too busy looking for attention.

I must thank you for the efforts you have put in penning this blog. I’m hoping to check out the same high-grade blog posts from you in the future as well. In truth, your creative writing abilities has motivated me to get my own, personal blog now 😉

Spot on with this write-up, I seriously believe this web site needs a great deal more attention. I’ll probably be back again to see more, thanks for the advice.

Hi there, I do believe your blog may be having internet browser compatibility issues. Whenever I look at your web site in Safari, it looks fine however, if opening in IE, it’s got some overlapping issues. I merely wanted to give you a quick heads up! Other than that, wonderful site.

Way cool! Some very valid points! I appreciate you penning this write-up plus the rest of the site is really good.

Having read this I believed it was very enlightening. I appreciate you finding the time and effort to put this content together. I once again find myself personally spending way too much time both reading and posting comments. But so what, it was still worthwhile!

You should be a part of a contest for one of the most useful sites on the internet. I will recommend this web site!

Ned was from a family of poor Irish immigrants, a maligned group in Australia at the time.

Good post. I learn something totally new and challenging on blogs I stumbleupon everyday. It’s always exciting to read through content from other writers and practice something from their web sites.

Can I simply say what a relief to discover a person that truly understands what they are discussing on the internet. You actually understand how to bring an issue to light and make it important. More and more people have to check this out and understand this side of your story. I can’t believe you are not more popular because you most certainly possess the gift.

This blog was… how do I say it? Relevant!! Finally I’ve found something that helped me. Thank you!

I enjoy reading through an article that will make men and women think. Also, thank you for allowing for me to comment.

I couldn’t refrain from commenting. Exceptionally well written.

Oh my goodness! Impressive article dude! Many thanks, However I am encountering troubles with your RSS. I don’t understand why I am unable to join it. Is there anyone else getting identical RSS problems? Anyone that knows the solution can you kindly respond? Thanks.

I was pretty pleased to find this site. I want to to thank you for ones time just for this fantastic read!! I definitely really liked every bit of it and I have you bookmarked to see new information in your site.

I really love your site.. Pleasant colors & theme. Did you develop this site yourself? Please reply back as I’m looking to create my very own site and would love to know where you got this from or what the theme is named. Kudos!

Thank you sharing such informative blog to us. I never see or heard about this insects. I love to watch national geographic, discovery channel because it shows the most amazing and beautiful animals and insects which we never saw in our entire life. Here, in this as well you share these insects which I never saw anywhere and its life cycle. I love this blog. Thank you once again for sharing this blog with us. Please keep on sharing such informative things in coming days as well. Cheers

I was able to find good info from your content.

Good article. I absolutely appreciate this website. Stick with it!

I was pretty pleased to discover this site. I wanted to thank you for ones time for this particularly wonderful read!! I definitely savored every part of it and I have you book marked to look at new stuff on your website.

This website was… how do I say it? Relevant!! Finally I’ve found something which helped me. Thank you!

Can I simply just say what a relief to discover someone that actually knows what they’re talking about on the net. You definitely know how to bring an issue to light and make it important. A lot more people need to look at this and understand this side of the story. It’s surprising you aren’t more popular since you most certainly possess the gift.

I couldn’t refrain from commenting. Exceptionally well written!

Way cool! Some very valid points! I appreciate you writing this write-up and the rest of the website is also really good.

Your blog is like a breath of fresh air. Thank you for your insights, your positivity, and your unwavering encouragement.

Your blog has become a true source of inspiration in my life. Every post seems tailored to what I need in that moment, offering both comfort and motivation. Thank you for your continuous kindness and encouragement; I always leave here with a refreshed mind and a hopeful heart.

I really love your blog.. Excellent colors & theme. Did you develop this web site yourself? Please reply back as I’m planning to create my very own blog and would like to learn where you got this from or just what the theme is named. Kudos!

You ought to take part in a contest for one of the greatest websites online. I will recommend this website!

While these properties often come at surprisingly low prices, they can present their own challenges as well.

After looking into a handful of the articles on your website, I seriously like your technique of writing a blog. I added it to my bookmark webpage list and will be checking back soon. Take a look at my web site too and let me know your opinion.

Digital albums now account for 15 of total album sales.

I really like it when people get together and share ideas. Great website, continue the good work!

I really enjoy this idea. Keep it up! 소액결제현금화 d20r4ti52h

With nationwide local elections in 2007already in sight, more cities are speeding to construct tramways.

HAMI is carving out a unique niche by offering a managed account program that monitors and trades over 70 diversified commodity markets, while trading accounts as small as $30,000.

I love looking through a post that will make people think. Also, thank you for allowing for me to comment.

Your blog makes my day brighter. Thank you for your kindness and encouragement!

If the rating had been equal after the rapid portion, up to five mini-matches of two blitz games would have been played, each mini-match comprising two blitz video games with a time management of 5 minutes per side and a 3-second increment beginning with move 1. The primary participant to win such a mini-match would have been declared the champion.

It’s hard to come by knowledgeable people in this particular topic, but you seem like you know what you’re talking about! Thanks

There’s certainly a lot to know about this topic. I love all of the points you made.

FIFA. 15 July 2018.

Your posts are filled with such compassion and understanding. Thank you for creating a space that feels welcoming and safe, a place where I can find the encouragement I need to keep going.

Good day! I could have sworn I’ve visited your blog before but after looking at a few of the posts I realized it’s new to me. Anyways, I’m certainly pleased I came across it and I’ll be bookmarking it and checking back frequently!

In 1986 this rate was up to 4 naira to $1 naira.

After checking out a handful of the articles on your website, I seriously like your technique of blogging. I saved it to my bookmark site list and will be checking back in the near future. Take a look at my website too and let me know what you think.

It involved chasing a bull through the streets of a town until it was weakened, then slaughtering the animal and butchering it for its meat.

Having read this I believed it was really informative. I appreciate you spending some time and energy to put this short article together. I once again find myself spending a lot of time both reading and commenting. But so what, it was still worthwhile.

One such gem is “Roberta’s,” situated in Brooklyn’s Bushwick neighborhood.

Excellent site you’ve got here.. It’s difficult to find high-quality writing like yours these days. I truly appreciate people like you! Take care!!

After I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and now each time a comment is added I receive 4 emails with the same comment. Is there a means you can remove me from that service? Thanks.

Your style is very unique in comparison to other folks I’ve read stuff from. Many thanks for posting when you have the opportunity, Guess I will just book mark this blog.

I wanted to thank you for this good read!! I definitely loved every bit of it. I’ve got you bookmarked to look at new stuff you post…

I’m so grateful for the sense of calm I find here. Thank you for sharing your insights and wisdom with such a generous heart.

There’s certainly a great deal to know about this subject. I love all of the points you made.

diet foods that are nutritious would be the best for our bodies, most diet foods are not very nutritious.

Hello there! This blog post couldn’t be written any better! Looking at this article reminds me of my previous roommate! He continually kept talking about this. I’ll send this article to him. Fairly certain he’s going to have a good read. I appreciate you for sharing!

Your style is really unique compared to other folks I’ve read stuff from. Thanks for posting when you have the opportunity, Guess I’ll just bookmark this page.

An intriguing discussion is worth comment. I believe that you need to write more on this subject matter, it may not be a taboo matter but typically people don’t talk about such subjects. To the next! Kind regards.

In short you have acquired an improved possiblity to match breast augmentation aventura his or her associate due to the greater lots of daters. It is additionally less complicated to satisfy folks on the web thanks to on the internet date web-sites as well as boards.

Can I just say what a aid to find somebody who really knows what theyre speaking about on the internet. You positively know how one can deliver an issue to gentle and make it important. More people have to read this and perceive this side of the story. I cant consider youre not more standard since you definitely have the gift.

A motivating discussion is worth comment. I believe that you need to write more about this subject, it might not be a taboo subject but generally people do not talk about these issues. To the next! Cheers.

The next time I read a blog, Hopefully it won’t disappoint me as much as this particular one. After all, Yes, it was my choice to read through, however I genuinely believed you would have something useful to say. All I hear is a bunch of complaining about something you could fix if you were not too busy looking for attention.

Hello I want to to share the remark here regarding you to be able to let you know just how much i actually Liked this particular read. I have to elope to aTurkey Day Supper however desired to depart you a simple remark. We saved a person So will end up being coming back subsequent function to see more of yer high quality articles. Continue the quality work.

I will immediately take hold of your rss as I can’t to find your email subscription hyperlink or newsletter service. Do you have any? Kindly permit me understand so that I may just subscribe. Thanks.

Aw, this was an exceptionally nice post. Taking a few minutes and actual effort to generate a very good article… but what can I say… I procrastinate a lot and never seem to get nearly anything done.

In lots of circumstances, lighting roadies must be comfy working excessive in the air, as many lighting booms must be installed and later disassembled excessive above the stage at each present.

Hi there! I just want to offer you a huge thumbs up for the great information you have got right here on this post. I’ll be coming back to your site for more soon.

In the modern world, such posts are becoming increasingly relevant and important for everyone https://zlnk.ru/#

Like 4869

เว็บสล็อตที่ดีที่สุดตลอดกาล เว็บตรง มั่นใจปลอดภัย 100

เว็บสล็อตไม่ผ่านเอเย่นต์ ฝากถอนไม่มีขั้นต่ำ นำเข้าเกม API แท้ สล็อตเว็บตรง แตกหนักทุกค่ายเกมสล็อตทั่วโลก!

สล็อตออนไลน์ไม่ผ่านเอเย่นต์ แตกหนักทุกเกมต้อง สล็อตเว็บตรง ที่ได้การยอมรับว่าเป็นเว็บสล้อตมาตรฐานระดับสากล

Wow! This article is great! – I learn something new everyday! Thank you! If you don’t mind, I’d like to reference this post on my blog. I will link back to this post. Thanks again!

May I just say what a relief to uncover an individual who really understands what they are talking about over the internet. You certainly realize how to bring an issue to light and make it important. More people really need to look at this and understand this side of your story. I was surprised you are not more popular given that you most certainly have the gift.

Lawrence Boudreaux was born March 10, 1922, in Church Point, Louisiana.

As an expert in interior design, I encourage you to infuse your character into these concepts, making your area a true reflection of your love for anime.

The pump isn’t turning on: Examine the ability provide and circuit breaker.

This is a good tip especially to those new to the blogosphere. Short but very accurate info… Many thanks for sharing this one. A must read article!

I got what you mean , thanks for posting .Woh I am happy to find this website through google.

I could not refrain from commenting. Well written.

Many thanks for this info I has been hunting all Yahoo in order to locate it!

Hey! Great post! Please do tell us when we can see a follow up!

I seriously love your site.. Great colors & theme. Did you make this amazing site yourself? Please reply back as I’m wanting to create my own personal website and would like to learn where you got this from or what the theme is named. Thanks!

I blog frequently and I really appreciate your information. This great article has really peaked my interest. I’m going to take a note of your site and keep checking for new details about once per week. I opted in for your RSS feed as well.

Establish a web site for the convention and ship the URL to the SIGPLAN Information Director (as quickly as date and site are determined).

A few of the danger departments/capabilities embrace Advertising, Strategic Planning, Compliance and Ethics, Accounting, Law, Insurance coverage, Treasury, Operational High quality Assurance, Operation’s Administration, Credit score, Customer support, and Inside Audit.

เว็บสล็อต ที่เชื่อถือได้ รับประกันความปลอดภัยต้องที่ สล็อตเว็บตรง เท่านั้นในปี 2025

สล็อตออนไลน์ ไม่ผ่านเอเย่นต์ สล็อตเว็บตรง เว็บแท้ลิขสิทธิ์หนึ่งเดียว มาตรฐานระดับสากล

Great web site you have here.. It’s difficult to find excellent writing like yours these days. I honestly appreciate people like you! Take care!!

It’s nearly impossible to find well-informed people about this topic, however, you sound like you know what you’re talking about! Thanks

Way cool! Some extremely valid points! I appreciate you writing this write-up and the rest of the website is very good.

กินอะไรก็กิน แต่ชอบกินหีหมา และต้องเป็น หีหมาทอดกรอบ หีที่อร่อยกว่าหีทั่วไป

Very nice write-up. I certainly love this site. Continue the good work!

Lipstick traces, smokers’ traces, vertical traces — name them what you will, lip strains are one of the indicators of aging you’d rather not have to deal with.

Next time I read a blog, Hopefully it won’t fail me as much as this one. After all, Yes, it was my choice to read, however I really thought you would probably have something interesting to talk about. All I hear is a bunch of moaning about something that you could fix if you were not too busy seeking attention.

News about some features, like a 4G connectivity component, come from RIM itself.

Since becoming a member of the club, he grew to become a first choice goalkeeper for Júbilo Iwata.

Yep – you guessed it – by no means a replyto thee-mail, and even areturn call.

It’s nearly impossible to find well-informed people for this topic, but you sound like you know what you’re talking about! Thanks

An outstanding share! I have just forwarded this onto a colleague who had been conducting a little research on this. And he in fact bought me breakfast due to the fact that I found it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanx for spending time to discuss this issue here on your internet site.

This is a topic that’s near to my heart… Take care! Where are your contact details though?

I love how this blog covers a variety of topics, making it appeal to a diverse audience There is something for everyone here!

Jenn, sorry to hear about your problem. Yes, you’re right. The fault may very well be with the primer. As a rule, water-based foundations should be used with water-based primers, and silicones-based foundations with silicones-based primers. That way, they work their best. You can try and ask for a sample of a water-based primer at your local counter, so you can test how you like it without wasting money. Hope this helps. This is arguably the top-selling primer on Amazon, and shoppers say they haven’t found a better one at this price point since! On top of it being affordable, the formula may also help even out your skin tone, in addition to giving you the ultimate canvas for makeup application. Some have even compared it to higher-end counterparts and found that this primer does the job better!

https://worlds-directory.com/listings12950433/concealing-eyebrows

The Black Kohl Eyeliner Pencil creates fierce definition and blends effortlessly for smouldering eyes in an instant! The creamy formula melts onto the skin and precisely lines and defines the lash line and waterline. Rock sexy, sultry, smoked-up eyes in an instant!The Liquid Eyeliner Pen has a super fine, precision brush tip to give you professional, laser-sharp, smudge proof lines. Accentuate the lash line and achieve the ultimate cat-eye effect with this fast drying liquid eyeliner. The fine brush tip glides onto the skin and can be easily controlled by applying more pressure, helping to create uber chic lines that last all day long! European Courier Delivery (DPD) Deliveries to France, Germany, Netherlands, Spain, Italy, Denmark, Poland, Austria, Belgium, Sweden, Portugal & Finland will now use a courier service. This is a faster shipping service than current postal times with shipping now estimated within 5-7 working days.

เว็บสล็อตออนไลน์อันดับ 1 การเงินมั่นคง สล็อตเว็บตรง ที่หนึ่งของประเทศไทย

There’s certainly a great deal to know about this subject. I like all the points you have made.

I truly love your website.. Excellent colors & theme. Did you build this website yourself? Please reply back as I’m trying to create my own site and would love to find out where you got this from or just what the theme is named. Appreciate it.