Domesday 2.0 – A Feudal World Order – Blake Lovewell

Audio Preview from a segment on TNT Radio:

Domesday 2.0 – A Feudal World Order

Does a global ‘Unified Ledger’ for finance represent the creation of a worldwide Domesday Book?

In a recent discussion with Patrick Henningsen of 21st Century Wire, we debated the instigation of digital currencies and compared them with the writing up of the Domesday book. Here below is a follow up to that conversation. It includes an academic investigation into the creation of the Domesday Book itself and a comparison to the ‘unified ledger’ proposed by the Bank of International Settlements.

Part 1: Domesday – The book, The Revolution.

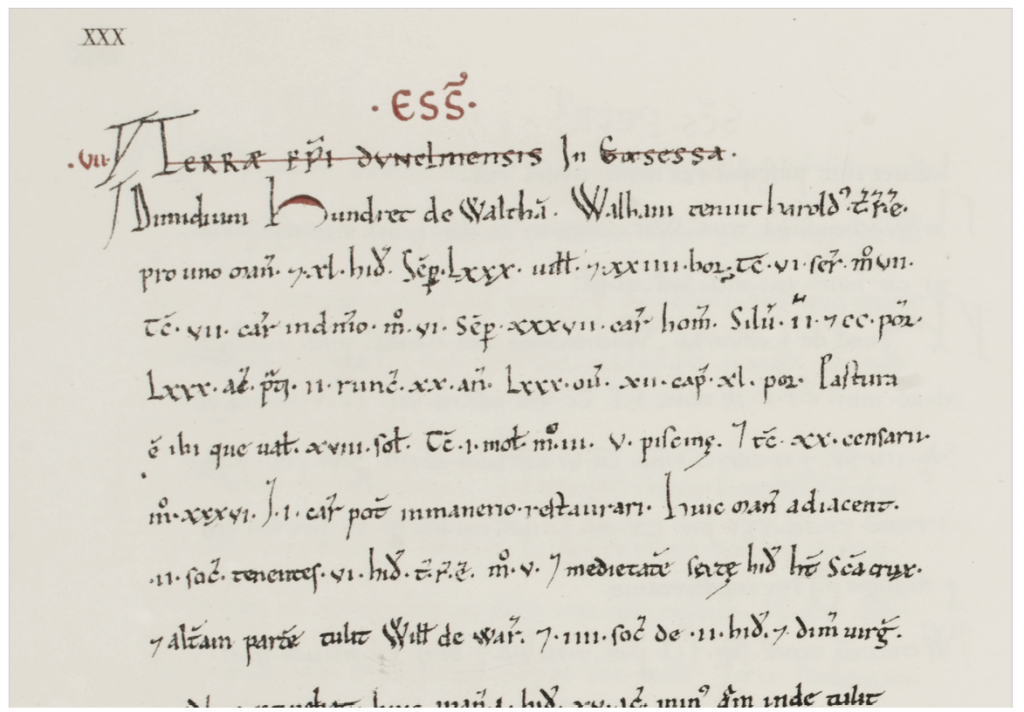

Domesday, or Doomsday was not the official designation of William the Conqueror’s fiscal annal. Contemporaneously the book was known as ‘The Description of England’ mainly consisting of a main first volume with a supplemental second volume for regions not included in the first. The popular name Doomsday (or Domesday in olde English) comes from the biblical term ‘Doom’s Day’ or Judgement Day. It is defined in Encyclopedia Britannica as the day; “when men face the record from which there is no appeal”. This ominous nomenclature emerged in the century following the creation of the book(s) and is well worth bearing in mind throughout our discussion.

At the outset of the Domesday project, was a wish amongst William the Conqueror’s administrators to refine the system of taxation and honour in England. Stephen Baxter, one of the foremost Domesday chroniclers, states it thusly: “An operation of this scale and sophistication must have been carefully planned, probably over a long period by the inner circle of administrative agents … for years before 1085.” As a sidenote his full paper is well worth reading if you want to understand the threads of debate that encircle England’s oldest financial ledger, and I will draw from it heavily. Thus in 1085 there was an administrative effort to codify the arrangements of King, Baron and peasantry.

At the time of it’s writing there was an ascendant kingdom of Danes to the East of England, led by King Sweyn Forkbeard of Denmark. This brings us to another important term throughout the debate on Domesday, the ‘Geld’. This was a tax first levied in 1012 by King Aethelred the Unready to pay for mercenary protection – the term ‘heregeld’ translates to ‘army tax’. It was the first annual universal tax in Europe. After the conquest of England by the Danes under Cnut the Great, the Geld system continued, under new ownership as Danegeld. The basis of calculation for this tax was hides. A vital commodity in Olde England, mammal hides were used for clothing, as well as the byproducts for food and other uses. A measure of the productivity of an area of land was how many hides it could produce, and thus a tax was levied in proportion to the hide bearing capacity of the land.

These Geld lists were used as source material for the Domesday books. Domesday entries combine testimony drawn from written records, oral testimony of hundredal jurors, and the knowledge of manorial officials. A hundred, by the way, was a sub-category or district within a county, known then as a shire. This Geld system would be absorbed and subsumed after the arrival of the Normans. Now we can witness the new nationwide political structure that William and his administrators were imposing on England: Feudalism.

Feudalism from the latin ‘feudum’ meaning fief or estate is also known as manorialism – after the manor houses which were the focus of small communities in 11th century Britain. The feudal system entrenched an informal system of subsidiarity. In feudalism the hierarchy progressed from the peasant class, through the Manors to the Hundreds, then up to the level of Shires and ultimately to the King. It put great importance on the system of barony where honours could be conferred by the King to his loyal Barons. It is often represented as a pyramidal hierarchy with the king at the godhead and peasantry at the wide base. The pivot towards feudalism would lay the foundations for the era of strong monarchies in Europe.

It is easy to see the benefit of this system for the King, not only could he continue his taxation but would have a system of subordinate bureaucracy to pursue his various goals. The honour system keeps the baron class in check and always vying for royal favour, whilst those barons keep their subjects in order, ensuring a stable system of governance. Stability is something that rulers always seek, and we will bring that motive back in when discussing financial institutions later.

In calcifying the previous Geld system, William would make sure his right to precious tax revenue. From Maitland’s analysis: “If the huge sums mentioned by the chronicler had really been exacted … William might well regard the right to levy a geld as the most precious jewel in his English crown.” Thus we can readily understand the imposition of feudalism when there had been revolts among the peasantry in England in the 11th Century and there was the ever present threat of war from the Danes. The historical trends were all in place for the feudal order to be formalised. William was not straying far from the system that existed. In the view of Douglas, a 20th century domesday-phile: “It was … the result of a great judicial inquiry that was directly connected with the very extensive litigation that inevitably followed a conquest by a King who strove at all costs to uphold tradition”

Yet the imposition of a system of governance rarely works well when it is solely top-down and driven by a dictator. There were in fact benefits throughout the pyramid hierarchy in having a codified, or written down, system of government. It was apparently much the fashion in the Victorian era to look back at the Domesday era in a patronial fashion, to see it as the beginning of the era of empire-building and of England’s success story. To quote Baxter: “the idea that the Domesday survey was intended to make the geld system fairer and more efficient became the prevailing orthodoxy”. By taking accurate account of each manor’s affairs, the geld or taxation could be carried out more fairly. The system was quite precise: “Their fiefs are described consecutively and consist of long lists of manors, with the names of their holders in 1066 and 1086, their dimensions and plowing capacity, the number of agricultural workers of various sorts, their mills, fishponds, and other amenities, and finally their values in pounds.”

The post-Domesday system of tax collection marked an important change too in terms of currency. It detailed the taxes due, for the most part in shillings, and pieces of gold. “Linton and

Lugwardine paid £10 of white pence with Lugwardine also paying one ounce of white gold.” This marked a change from the Danegeld collection of hides and other agricultural produce. The administrative system instituted by William would boil these products down to a monetary value, a monetarism that continues to this day. These dues were not set at a free market value. Some regions would be taxed more punitively, and some less, depending on who were in favour. Whilst there was a transition to monetary valuation, there was still some space for the old barter economy. It is recorded that “From Linton, Ilbert the sheriff had customary dues of honey and sheep, … From Kingstone the villagers took the produce of the hunt to Hereford and the King was paid 1 hawk … Finally, from Marden came 25 sticks of eels”.

Walter de Gray Birch in 1887 pushed the Victorian, pro-Domesday, argument further. He alongside other Victorian historians theorised that the Domesday system of administration enabled the emergence of a formalised justice system. “The object of the survey, ostensibly, was this: that every man should know, and be satisfied with, his rightful possessions, and not with impunity usurp the property of others”. He shows us how a tightly regulated accounting system could benefit justice through maintaining accurate records. As Holt puts it: “[The] Domesday Book seems to embody a hard-headed deal. William got a survey of his own and his tenants’ resources; he was strengthened in the exercise of his feudal rights. His tenants got a record of their tenure, in effect a confirmation of their enfeoffment.” Yet many authors disagree that the intention at the outset was to enshrine justice. In fact if we look into some of the satellite documents around the Domesday books we find a different perspective.

Michael John Jones, a fiscal historian tells us: “William I required each tenant in chief (e.g., bishop, abbot or baron) and each sheriff of each English county to provide an initial list of both manors and men. This, in itself, was a major and unparalleled intrusion of the government into the lives of individual citizens.”

Furthermore, “[…] We must recall that the author of the annal for 1085 was shocked by the survey’s intrusiveness; that landholders were required to attend the survey on pain of forfeiture; that jurors did so on pain of fine; and that most of the Englishmen who attended the public sessions of the survey would have been compelled to witness and confirm, on oath, both the loss of their patrimony and the diminution of their social status.” This quote comes from Sally Harvey who’s book, Domesday: The book of Judgement, embodies a modern perspective on the Domesday era. Drawing upon what little hard evidence we have she describes a rather tyrannical system of information extraction. There is the threat of forfeiture if you do not submit to the king’s arbiters. There is the threat of fines too, amongst other social threats to reputation. The process of the Domesday Survey was a very public affair with no confidentiality adding an element of public oversight as well as demonstrating the King’s power to the masses. It is worth reminiscing on the first quote of the article, that Domesday is the record from which there is no appeal”. In this perspective the inception of feudalism was a means to put the informal game of kingmanship into a formal structure on a permanent basis.

This financialisation was part of the recipe for the Norman ideology’s success, as quoted in Stenton’s biography of William the Conqueror: “Domesday is essentially a financial document; it is a noteworthy example of that insistence on their fiscal rights which was eminently characteristic of the Anglo-Norman kings, and was the chief reason why they were able to build up the strongest government in Western Europe.” The Normans ruled by their control of finances and administration. To my eyes, the Norman model has echoes through to present day structures of control. I believe that much control exerted by governments and institutions is financial which can appear as apolitical – it’s only a little geld to fund the army and stave off the Vikings – but it quickly and summarily creates systems of control, regulation and data gathering. I do agree that the Domesday’s creation did allow for justice, much in the vein of the US constitution’s forefronting the right to property. I think that on balance this was the only concession that the baronial class were able to ensure as the new Norman order asserted its right to rule, and the King’s right to own England’s green and pleasant land as a whole.

To quote from Jones again: “It was Domesday Book which provided the infrastructure upon which a monetarised accounting system could be used to raise taxes to fund the military system. The non-physical disciplinary power thus complemented the state’s physical disciplinary power.” The financial arm had won in an arm wrestle with the strong arm of the military, the pen had bested the sword. Let that take us to the modern era.

Part 2: A Unified Ledger – A Global Domesday Book

Here is the title of the Bank for International Settlements’ latest annual report: “Blueprint for the future monetary system: improving the old, enabling the new”. The “old” they wish to improve is the entire global economic system. The “new” they wish to “enable” is a unified system of financial control, with them at the helm.

The Bank for International Settlements is a shady organisation, and as we know evil thrives in the dark. They represent a collection of central bankers and high-flying financiers. Their role is the lender of last resort for the world’s national central banks. They underwrite the activities, and liabilities of central banks, promising to back any of their actions. In return the BIS has a hold over the policy direction of those central banks.

Over the last few years they have been lobbying for and pursuing various different CBDCs: Central Bank Digital Currencies. These would be a digital form of national currency. They would be a new class of asset, and a liability on the balance sheet of central banks, somewhat similar to how money is minted today. However, a CBDC would sideline retail banks, those high-street banks or international banks who currently hold accounts for people. The CBDC would represent a direct interaction between central banks and citizens. We must bear in mind that presently most central banks are not directly an arm of government. The Federal Reserve in the USA is a private corporation. Likewise the Bank of England is a supposedly independent institution, although we can see a short leash held by the treasury and often governments work in lock-step with their central banks to control the distribution of currency. Please see my article: The 7 Pillars of a CBDC System for more information.

The BIS have been undertaking experiments across the world in CBDCs: Operation Helvetia in Switzerland, Operation Genesis in Hong Kong, Dunbar in Singapore and in the UK Project Rosalind. Each of these projects utilise a different aspect of CBDC architecture. Project Rosalind for example built up an API; an Application Programming Interface to allow for the interaction between CBDCs and private company programs for retail ‘customers’. In my opinion they are not really customers as if a CBDC were adopted it would be a state service, and possibly mandated, but that’s their terminology. Here we witness the birth of their ‘new’ system, or at least one aspect of it: a centrally controlled digital currency, available through a private company’s computer program, for the citizenry to use. Which is all well and in theory, yet when we expand the philosophy behind the curtain, things look a little more dystopian. We should bear in mind too, that the name Rosalind comes from the scientist Rosalind Franklin, the first to photograph DNA’s double-helical structure using X-rays. Not to derogate her work at advancing science, but it is perhaps a revealing choice of name for a worldwide scheme of control; to record the minutae of the world’s financial DNA.

There is no strong use-case for a CBDC for the public. In a BIS document we find the tautology: “CBDC adoption would likely be driven by its future usefulness to users”. That is to say, it’s useful because if everybody uses it, it will be useful to use. Well behind this Dr Zeussian phraseology we find the thrust of the policy. That is, the policy will be forced upon the population against a natural demand. The next sentence is also revealing: “Central bank money is the safest form of money available”. Well I would posit that central bank money – such as the US Dollar – is not that safe. In fact the purchasing power of the dollar has fallen by around 98% since the early 20th Century. When the currency is printed at a high speed it devalues the existing currency supply. Central banks control the printer – they can not only mint new currency but have many other ways to build up the liability side of their balance sheet by buying sovereign debts, writing off debts, and issuing bonds.

Right now the only thing stemming the voracious money printing is something called the zero-lower bound. It’s a nice technical economic term but it is at the fore of the mind of central bankers. It is something that the ECB (European Central Bank) would like to do away with. The zero lower bound is the point at which central bank interest rates go to zero or below. That means that any currency held, let’s say Euros in a bank account, will earn no interest and potentially be eroded by negative interest rates. Well it’s not an attractive proposition to account holders so people would take their money out of the account – into cash, gold or other assets and the bank would lose out. This is the zero lower bound ‘problem’ – when those pesky citizens pull their own money out of the bank. It is the force which stops central banks pursuing negative interest rates – a magic tool which would balance out all of their reckless money printing.

Marvin Goodfreind was appointed by President Trump to the Federal Reserve in the USA. He is from the monetarist school of thought and is a member of the aptly named Shadow Open Markets Committee. This school of thought follows the work of Milton Friedman that central bank policy is the key driver of inflation and economic growth. This may well be the case, however when they get the reins of power they begin advocating for unorthodox policies like destroying all value in the currency. “In the next crisis, he says, the Fed might want to push interest rates into negative territory to prod people to stop sitting on their money and do something with it” We should note that the Goodfriend here seems aware of ‘the next crisis’ and would like to use it as their chance to “unencumber” themselves of the zero lower bound problem.

The key tool for keeping money in the system during a crisis would be digital currency. In his 2017 paper he tells us: “the public would likely find electronic currency an acceptable alternative to paper currency.” His only lament is that there would have to be work at the central bank level to develop the tools and systems to operate a digital central bank system. Well lo and behold, 6 years down the line we have a smorgasbord of CBDC tools pushed out by the BIS and being toyed around with by various central banks and governments the world over. It seems like the monetarists are winning the argument as the standard approach to rein in inflation seems to be faltering.

The trouble with central bank digital currencies, in my opinion, is control. Finance is already one of the strongest chains which bind humans in society; be it through rents and taxes, the constant rising cost of goods and services, the diminuition of common land and any ability to live free on the land – forgive the luddite’s lament. But I make no bones about the argument that the CBDC system is purely for control. Ones privacy would be lost as the central authority could view your every financial move. Couple this with the omniscient surveillance state which can monitor your heartbeat through your phone, track your face around a city, and you have the Orwellian Big Brother state. There is a weak use case for the user – they would probably have to bribe people to start using the CBDC system. And as such it would be a top down imposition.

The Domesday thread ties neatly in with a modern invention of the financial class: tokenisation. An asset is tokenised when a corresponding token is created on a blockchain. Right now this process is academic, as anybody can create a blockchain and token and try to sell it to the public, as many do. However, the BIS is more precise in their proposal. They want to be the institution to create the giga-blockchain (my term) for the worldwide financial system. This blockchain, far from being a cryptocurrency, would hold financial data, contracts, assets and anything else the BIS would like to vacuum up into their remit. Thus by creating a ledger, a 21st Century book of sorts, which contains a list of who owns what asset, they would be as William the Conqueror cementing his dominance over his servile subjects.

Whilst this seems an academic affair and my fars of institutional overreach may be unfounded, there are many trends worth noting that strengthen the notion. Firstly is the assetisation of nature. We have had in the last few years, the trading of natural assets on the New York Stock Exchange. These ‘Natural Asset Corporations’, proposed and created by the Rockefeller Foundation could easily become the tokenised assets of the BIS’ system. To quote Whitney Webb: “NACs will not only allow ecosystems to become financial assets, but the rights to “ecosystem services”, or the benefits people receive from nature as well. These include food production, tourism, clean water, biodiversity, pollination, carbon sequestration and much more”. The conqueror’s remit expands ever further. These NACs are a stepping stone, in the words of the World Bank: “…until nature emerges as an asset class of its own”.

In my researches I found a second worrying aspect to the BIS’ global control program: A digital feodary, one who collects information and taxes in a feudal system. Far from the men on horseback galloping from town to town, the BIS have piloted a techonolgical system of surveilling nature. Their Project Genesis 2.0 aims to expand the use of Internet of Things technology (IoT) to monitor natural assets. The BIS would issue the smart contract token of a natural asset along with the ability to continuously monitor them: “The MOIs are digitally tracked and automatically delivered to investors, through the use of distributed ledger technology and smart contracts, combined with IoT devices tracking the carbon credits at source”. I envisage monitors clamped to trees, drones flying over forests with high-tech cameras, gas monitors throughout poly-tunnels, and a network of buoys measuring, assetising and trading outputs from an algal bloom. This is not science-fiction, there has already been a project in a Chinese city to utilise the 5G and 6G infrastructure to monitor many ‘natural’ phenomena, to convert them to data witht the aim of creating a real-time system of carbon credit monitoring. This project is only the first of many, and as the trend of so-called ‘smart-cities’ continues, we can expect the monitoring of nature to continue apace.

To close I will quote Tobias Adrian, Director of the Monetary and Capital Markets Department at the IMF : “Expressed in today’s language,” he said, “the vision is for a trusted ledger, which is essentially an electronic document representing property rights on which digital versions of central bank reserves in any currency can be traded among participants.”

Conclusion (tl;dr)

A ruler seeks control and stability. William the conqueror sought to secure his control over the British Isles by using a system of administration. His system, feudalism, laid the foundation for a millennium of powerful monarchies. His Domesday Book, a ledger, offered him control over the people. It dictated who owned what asset and laid out how much tax was due to the ruler.

The ‘Bank For International Settlements’ propose a unified ledger. They help to dictate the world’s central bank policies. The ‘Unified Ledger’ is a worldwide digital database. By surveilling and overtly controlling global financial systems, central banks can be used to control the population. It is similar to the Domesday project. It seeks to codify financial assets, currencies as well as natural ‘assets’ into one worldwide blockchain. If they were successful with their plans it would be a Doom’s day; an account “from which there is no escape or appeal”. With the advances in surveillance technology there is much greater opportunity for control. As we broach a new age of financial technology, the age old rulers naturally seek to retain their control. I expect central banks and various institutions to force their way into the throne by using William’s Domesday methodology. A system of Dictatorial Accountancy. And Though I am ambivalent as to whether they will succeed, their imperial projects are our ominous prospects.

References:

III. Blueprint for the future monetary system: improving the old, enabling the new.

BIS Annual Economic Report | 20 June 2023

https://www.bis.org/publ/arpdf/ar2023e3.htm

BIS proposes a Global Unified Ledger:

https://www.ledgerinsights.com/bis-unified-ledger-tokenization/

Doomsday: Encyclopaedia Brittanica:

https://www.britannica.com/topic/Domesday-Book

Stephen Baxter: The Domesday Controversy: A Review and a New Interpretation:

Douglas: English Historical Documents:

https://archive.org/details/englishhistorica0000unse_i8w4/page/n11/mode/2up

Frederic William Maitland: Domesday Book and Beyond:

https://www.gutenberg.org/files/43255/43255-h/43255-h.htm

Walter de Gray Birch: Domesday Book:

https://archive.org/details/domesdaybook01birc

J.C. Holt: ‘Domesday Studies 2000:

https://openlibrary.org/books/OL8277462M/Domesday_Studies

Jones, M.J., Domesday book: An early fiscal, accounting narrative?, The British Accounting Review (2017):

https://research-information.bris.ac.uk/ws/portalfiles/portal/132980427/Domesday_book_2017.pdf

Sally Harvey: Domesday – Book of Judgement:

https://global.oup.com/academic/product/domesday-9780199669783?cc=gb&lang=en&

Stenton: William the Conqueror and the rule of the Normans:

https://archive.org/details/williamconqueror00stenuoft

The Tower of Institutional Corruption: The Bank for International Settlements In The Nightmare Years by Gregg Fields July 2, 2013:

https://ethics.harvard.edu/blog/tower-institutional-corruption

The 7 Pillars of a CBDC System – Blake Lovewell:

List of BIS CBDC international experiments:

https://www.bis.org/about/bisih/topics/cbdc.htm

BIS: Project Rosalind: UK CBDC API:

https://www.bis.org/about/bisih/topics/cbdc/rosalind.htm

BIS: Central bank digital currencies: user needs and adoption:

https://www.bis.org/publ/othp42_user_needs.pdf

Purchasing Power of the US Dollar Visualisation:

Zero Lower Bound – Investopedia:

https://www.investopedia.com/terms/z/zero-bound.asp

European Central Bank: How binding is the zero lower bound?:

https://www.ecb.europa.eu/press/key/date/2015/html/sp150519.en.html

Bloomberg: Trump’s Latest Pick for the Fed Is No Fan of Paper Money:

Smartphones monitor the user’s heartbeat:

Facial Tracking pushed out across London:

https://www.theguardian.com/uk-news/2020/feb/11/met-police-deploy-live-facial-recognition-technology

Whitney Webb: Wall Street’s Takeover of Nature Advances with Launch of New Asset Class:

World Bank: Background Note on Financing for Nature:

BIS: Genesis 2.0 – IoT surveillance and carbon credits:

https://www.bis.org/publ/othp58.htm

Exploring Cross-Border and Domestic Payment and Contracting Platforms, Speech by Tobias Adrian: